Implementing a trading bot strategy in PHP

Implementing a trading bot strategy in PHP involves using libraries and APIs to fetch market data, calculate technical indicators, and execute trades based on predefined conditions. PHP is not typically used for algorithmic trading due to its synchronous nature and lack of specialized libraries. However, we can still create a functional script to demonstrate the trading strategy.

Prerequisites

Before starting, you need to install the ccxt library for PHP. This library allows interaction with different exchange APIs such as Binance, Coinbase, and more.

Install ccxt using Composer:

composer require ccxt/ccxtPHP Implementation

Below is the PHP code for implementing the trading strategy:

<?php

require 'vendor/autoload.php';

use ccxt\binance;

$exchange = new binance(array(

'apiKey' => 'YOUR_API_KEY',

'secret' => 'YOUR_SECRET_KEY',

));

// Strategy settings

$symbol = 'BTC/USDT'; // The trading pair

$timeframe = '1h'; // 1-hour timeframe

$short_window = 20; // Short-term period for moving average

$long_window = 50; // Long-term period for moving average

$rsi_threshold_overbought = 70; // RSI overbought level

$rsi_threshold_oversold = 30; // RSI oversold level

$stop_loss_pct = 0.03; // Stop loss at 3%

$take_profit_pct = 0.10; // Take profit at 10%

function fetch_ohlcv($symbol, $timeframe) {

global $exchange;

$ohlcv = $exchange->fetch_ohlcv($symbol, $timeframe);

$data = array_map(function ($candle) {

return [

'timestamp' => $candle[0],

'open' => $candle[1],

'high' => $candle[2],

'low' => $candle[3],

'close' => $candle[4],

'volume' => $candle[5],

];

}, $ohlcv);

return $data;

}

function calculate_sma($data, $window) {

$sma = [];

for ($i = 0; $i < count($data); $i++) {

if ($i >= $window - 1) {

$slice = array_slice(array_column($data, 'close'), $i - $window + 1, $window);

$sma[] = array_sum($slice) / $window;

} else {

$sma[] = null;

}

}

return $sma;

}

function calculate_rsi($data, $window = 14) {

$rsi = [];

$gains = [];

$losses = [];

for ($i = 1; $i < count($data); $i++) {

$delta = $data[$i]['close'] - $data[$i - 1]['close'];

$gain = $delta > 0 ? $delta : 0;

$loss = $delta < 0 ? abs($delta) : 0;

$gains[] = $gain;

$losses[] = $loss;

if ($i >= $window) {

$avg_gain = array_sum(array_slice($gains, $i - $window, $window)) / $window;

$avg_loss = array_sum(array_slice($losses, $i - $window, $window)) / $window;

$rs = $avg_loss == 0 ? 0 : $avg_gain / $avg_loss;

$rsi[] = 100 - (100 / (1 + $rs));

} else {

$rsi[] = null;

}

}

return $rsi;

}

function calculate_bollinger_bands($data, $window = 20) {

$upper_bb = [];

$lower_bb = [];

$sma = calculate_sma($data, $window);

for ($i = 0; $i < count($data); $i++) {

if ($i >= $window - 1) {

$slice = array_slice(array_column($data, 'close'), $i - $window + 1, $window);

$std_dev = standard_deviation($slice);

$upper_bb[] = $sma[$i] + (2 * $std_dev);

$lower_bb[] = $sma[$i] - (2 * $std_dev);

} else {

$upper_bb[] = null;

$lower_bb[] = null;

}

}

return [$upper_bb, $lower_bb];

}

function standard_deviation($array) {

$mean = array_sum($array) / count($array);

$sum = 0;

foreach ($array as $value) {

$sum += pow($value - $mean, 2);

}

return sqrt($sum / count($array));

}

function check_entry_conditions($data) {

global $rsi_threshold_overbought;

list($upper_bb, $lower_bb) = calculate_bollinger_bands($data);

$rsi = calculate_rsi($data);

$latest_data = end($data);

$latest_rsi = end($rsi);

$latest_upper_bb = end($upper_bb);

if ($latest_data['close'] > $latest_upper_bb && $latest_rsi > $rsi_threshold_overbought) {

return true;

}

return false;

}

function check_exit_conditions($entry_price, $current_price) {

global $stop_loss_pct, $take_profit_pct;

if ($current_price <= $entry_price * (1 - $take_profit_pct) || $current_price >= $entry_price * (1 + $stop_loss_pct)) {

return true;

}

return false;

}

function enter_short_position($symbol) {

echo "Entering short position for {$symbol}\n";

// Implement real trade execution code with the exchange's API here

}

function close_position($symbol) {

echo "Closing position for {$symbol}\n";

// Implement real trade closing code with the exchange's API here

}

function trading_bot() {

global $symbol, $timeframe;

$data = fetch_ohlcv($symbol, $timeframe);

// Check entry conditions

if (check_entry_conditions($data)) {

$entry_price = end($data)['close'];

enter_short_position($symbol);

// Monitor for exit conditions

while (true) {

$data = fetch_ohlcv($symbol, $timeframe);

$current_price = end($data)['close'];

if (check_exit_conditions($entry_price, $current_price)) {

close_position($symbol);

break;

}

sleep(60); // Check every minute

}

}

}

// Run the trading bot

trading_bot();

?>Explanation of the Code

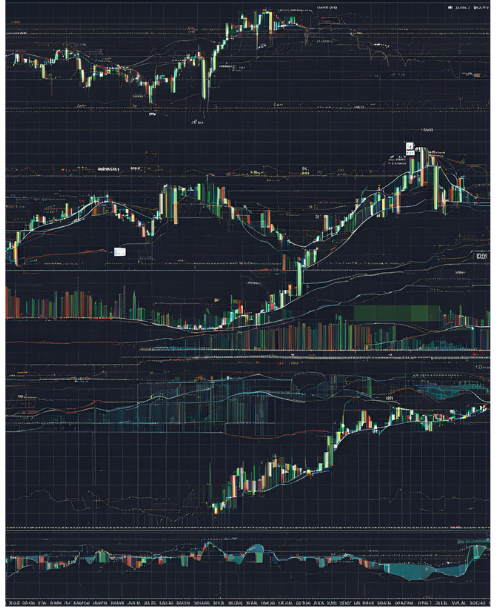

- Connecting to the Exchange: The script uses the

ccxtlibrary to connect to the Binance exchange and fetch market data. - Calculating Indicators: Functions are implemented to calculate technical indicators such as SMA, RSI, and Bollinger Bands.

- Entry and Exit Conditions: The bot checks for conditions to enter a short position and exit based on predefined criteria such as RSI levels and Bollinger Bands.

- Position Management: The bot automatically manages the position by entering when conditions are met and monitoring for exit conditions to take profit or limit losses.

Important Notes:

- Security: Always keep your API keys safe and secure.

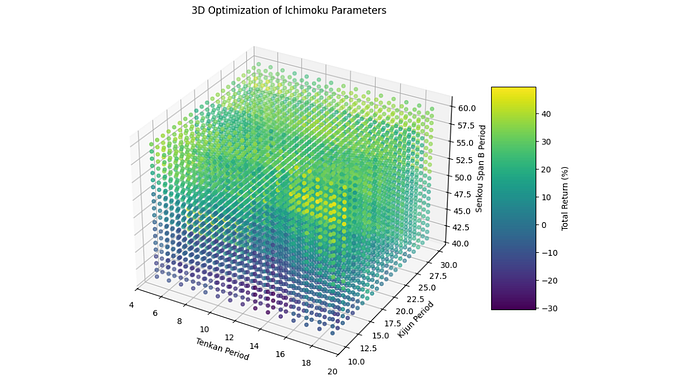

- Testing and Optimization: Always backtest and optimize strategy parameters using historical data to ensure its effectiveness.

- PHP Limitations: While PHP can be used for trading bots, Python or JavaScript is typically more suitable due to their libraries and asynchronous capabilities.

By following this approach, you can implement a simple yet effective trading strategy using PHP for short-term positions in financial markets.

Writen By Mohammad Nazarnejad